Nixa Police Ask Voters For Funding In April Election

Nixa Police Ask Voters For Funding In April Election

January 27, 2023

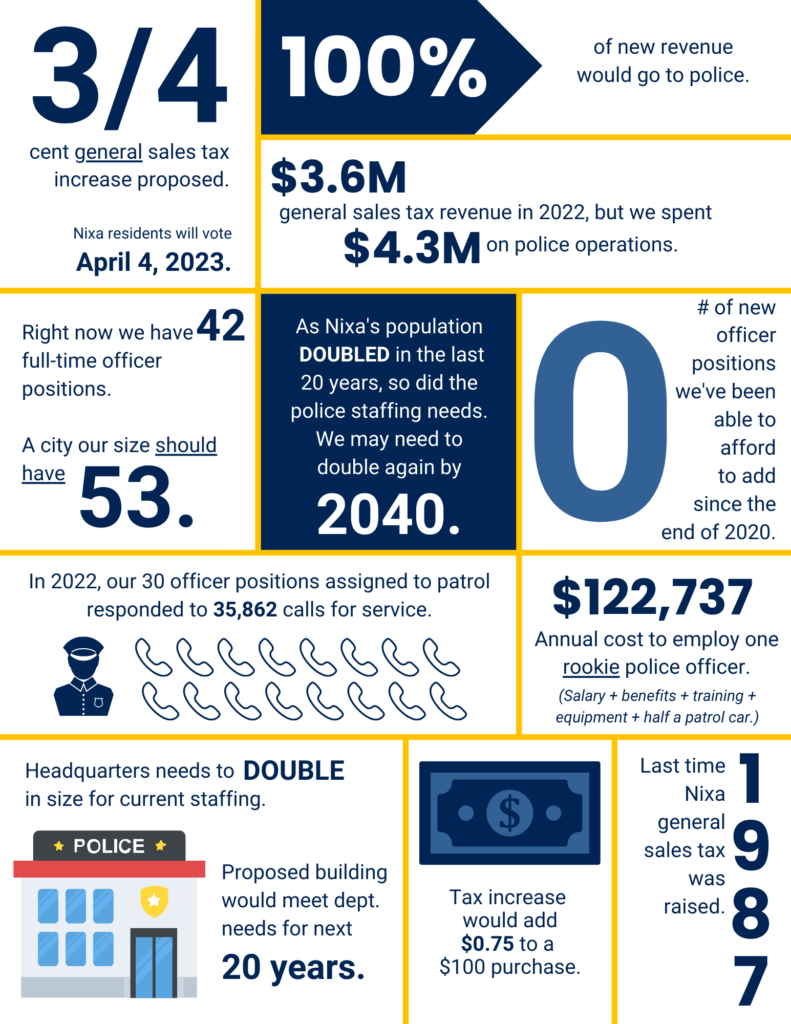

On April 4, 2023, Nixa voters will decide whether or not to increase the city’s general sales tax by ¾ cent to provide dedicated funding for Nixa Police.

To keep Nixa one of the safest communities in Missouri as our population grows, Nixa Police need more funding to add officers and build a headquarters which accommodates the next 20 years of growth.

More officers are already needed (currently we employ 42 full-time officer positions) based on the current demand for service but, due to budget constraints, we were not able to afford to add any new positions in the 2021, 2022 nor 2023 budget years.

“Nixa Police Officers are facing job burnout,” says Nixa Chief of Police Joe Campbell. “The lack of sufficient staffing often means officers are expected to work overtime to cover unfilled shifts or extra duty assignments.”

Annually, the Police Department has numerous “black out” days which means no officer can be off that day due to staffing requirements. Officers’ requests for time off are often rejected so that the department can meet minimum staffing requirements for a particular shift.

The Nixa Police Headquarters also needs to double in size just for current staffing. They need a new building with enough room for offices, evidence storage, and built for technology and officer safety. The current lack of space creates inefficient and frustrating situations as officers share work stations or sometimes have to wait before they can use our only multi-purpose room. Setting up or breaking down equipment in that room to prepare for different types of trainings or meetings means more time that officers are not on the road responding to calls for service. Some officers are working from offices which were converted from closets.

“There is no way the current city revenues can be stretched to meet the need for more officers”, says Nixa City Administrator Jimmy Liles, who previously served as Nixa’s Chief of Police. “If we cannot keep work conditions good for our Police staff, we may lose more good officers to other job opportunities and it only gets harder to recruit good officers.”

“The only way to stay on top of crime is to ensure we have enough officers on each shift to answer calls, handle emergencies, and suppress crime,” says Chief Campbell. “We also need support staff to do investigations, supervise personnel and conduct training.”

Nixa Police do not currently have their own dedicated funding source. They are by far the most expensive department funded by general sales tax revenues. In 2021, general sales tax revenue was just over $3.4 million, but the City spent $3.78 million for Police operational costs ($3.32 million of which was for personnel). In 2022, general sales tax revenue was $3.6 million, but the City spent $4.3 million for Police operational costs ($3.76 million of which was for personnel).

“A 3/4 cent general sales tax increase is the absolute smallest amount of sales tax increase required to be able to fund police department expansion and addition of needed officers”, says Liles. Nixa has not increased the general sales tax since 1987.

If the tax increase is not approved, it will force deeper cuts to all city departments including Police services.

You can learn more by reading answers to frequently asked questions below:

PAID FOR BY:

City of Nixa

Jimmy Liles, City Administrator

715. W. Mt. Vernon St.

Nixa, MO 65714

417-725-3785 | CityHall@Nixa.com

Frequently Asked Questions:

Why are you asking for another sales tax increase after voters said NO to a proposed sales tax increase in November 2022?

We listened to voter feedback who said they wanted an opportunity to vote for either funding for police or parks, but not another issue which would fund solutions for the problems both departments are facing. The Police Department’s needs are the most urgent, so we have brought that to voters again for consideration as the city’s top priority.

How much money does the Police Department spend currently?

In 2022, the Nixa Police Department was budgeted to spend $3.86 million on personnel,$0.5 million on operations and maintenance, $0.73 million on capital improvements (mostly on a shooting range where officers conduct firearms training), and $0.31 million on debt lease payments.

How much does it cost to employ each officer?

A level 1 rookie with no prior experience would start at $51,214 salary in 2023. We would also need to spend up to $27,573 on their benefits, $1,300 on training, $8,000 on uniform and equipment, and $34,650 for half the cost of a new police patrol vehicle. All together, that adds up to $122,737. We would need to keep all new positions on staff every year, and as the cost of inflation goes up, so will this price. We can’t feasibly hire and onboard more than a handful of new officer positions in a single year because we don’t have all the training resources needed, so if the tax is approved, we would create a handful of new police officer positions each year until our staffing is keeping up with our workload.

How do you know how many more officers are needed?

According to the Department of Justice (DOJ) midwest cities should have 2.2 officers per 1,000 residents. Nixa Police currently have 42 full-time officer positions. 30 of those positions are currently assigned to patrol. At a population over 24,000 people, the number of officers we need is 53. This takes into account the amount of staff required to meet our calls for service, time off, training time, administrative functions, etc. In 2022, the number of calls for service worked by Nixa officers was 35,862 including all proactive and reactive calls for service. The Nixa Police Department has a minimum staffing policy of 4 officers working patrol on each shift, 24 hours a day, every day of the year.

Could you make more cuts to the Police Department before asking for a tax increase?

We essentially have. Over the last three years, the Chief of Police has asked to add officers to meet the demand for service. The Police Department has not added any officers in the last 3 years due to budget constraints. Although we have not made cuts to number of staff, nor services and programs offered, every year we ask our officers to do more with less to continue to serve the public at the level they have come to expect. At some point, if additional funding for staff is not provided, we may have to cut services offered in order to manage the workload.

How much would the proposed Police Headquarters cost to build?

Approximately $13 million. It needs to be a three-story building with technology, evidence storage, offices, meeting rooms, training rooms, and security features designed to protect our officers as they start and end their workdays. This cost includes furniture and fittings. We would leave the 3rd floor unfinished on the inside initially, so we would have a space to grow into in the future, saving the city money in the long-run so we don’t have to build another building in a few years as the department grows. We know that construction costs will only go up in the future, so building space to grow into now makes the most economic sense.

Could you build a smaller/cheaper headquarters?

No. We currently have 41 full time officer positions. The current building was built when we had 20 officers. The building needs to be built to accommodate 80 officers as we predict that will be the size of the department by 2040. The cost of a 3-story building is $13 million while the cost of a 2-story building would be around $11 million. The 2-story building would only meet our current need, forcing us to ask for more money within a few years to do more construction, whereas the 3-story building means there will be enough room for at least 20 years of department growth. The current building has been remodeled 3 times and we have squeezed use out of every inch available to us, but due to the way it was originally constructed (to save pennies), we are not able to convert it into a 2-story building. There’s not enough room where it sits to be able to expand the footprint, so it makes more sense to tear down the Utility Billing office (move those staff into City Hall) and build the new headquarters on the land already owned by the city (which saves us significant money as opposed to buying land somewhere) where the parking lot and Utility Billing office are currently. Then, once completed, the Police staff would be able to move across the parking lot into the new building, and then the old building would need to be demolished to create more parking. This is also a better strategy than moving our department out temporarily to a rented space, demolishing the current building, and building new on the same spot.

How much revenue would be generated by a ¾ cent sales tax?

We anticipate approximately $3.1 million in new revenue to be generated in the first full year once the tax goes into effect (2024) for the Police Department if the ¾ cent tax increase is approved. We calculate this is just enough to afford the new officers, to make the bond debt payments for the Headquarters construction, and to maintain the larger building.

Could you have asked for a ½ cent tax instead?

A half-cent tax would not provide enough revenue to meet the needs we are trying to address for the Police Department. The revenue generated by a half-cent tax increase (estimated $2 million in the first year) would not be enough to cover both the debt payments on the construction of the new Police Headquarters and the addition of officers.

The City asked for a 1-cent increase in November to build a park facility and to meet the Police needs. How is ½ cent not enough for the Police?

If the November issue had passed, once the indoor sports complex we had proposed had been completed, it would have been able to generate enough revenue to offset how much money the Parks Department needs to draw from the General Fund in order to continue operating, meaning well more than half and likely about ¾ of the new money would have been freed up for the Police Department. So, a 1-cent increase would have been enough for both the Police and Parks needs. But the Police needs on their own require a ¾ cent increase.

Why not use ARPA money?

The ARPA money the city received is a one-time payment, so it doesn’t help us with recurring salary costs for new officers who we would need to keep on staff every year into the future. Also, at $4.5 million, the city did not get enough ARPA money to afford the Police Headquarters construction project. But the main reason is that there are new grants opening up which will require matching funds in order to pay for large infrastructure projects which will help our community. Our plan is to use our ARPA funds as our portion of the matching funds for such grants so we can essentially stretch our dollars even further to bring better infrastructure to our community.

Isn’t there other money the city already gets that it could use for Police?

No. The City of Nixa does not collect any personal property tax (for example: a car or boat) and the municipal government only receives about 5% of the total real property tax (only applied to real estate) Nixa property owners pay (most of your real property tax goes to other taxing districts including the Schools, County Government, Fire, Library, etc.) Also, not all city revenue streams can go towards Police. For example, legally, the money received from Nixa Utility customers paying their bills must be spent on Nixa Utilities, and we can’t spend that money on Police. Legally, we cannot use the .5 cent transportation tax nor the Missouri Motor Fuel Tax revenues we receive on anything but our Street department. Legally, we are limited on the degree to which we can fund the city through writing tickets, and we don’t want to be that kind of city anyway. Our officers often give more warnings than tickets because we believe driving behavior can be changed with warnings as well. The only money that can legally be spent on Policing is in the general fund. The largest revenue source for the general fund is the current 1% general sales tax. But the Police Department already spends more than 100% of that revenue on officer salaries alone. This means that from what’s left over in the general fund after funding our Police Department, we still have to pay to operate the Parks Department and administrative support departments like finance, HR, legal, and communications which the Police Department also depends upon.

How much would this tax increase cost me?

A ¾ cent general sales tax increase means that all shoppers inside Nixa city limits would pay an additional .75 cents on a qualifying $100 purchase. Certain purchases and transactions are exempt from sales tax per state law. Nixa’s municipal sales tax is lower than all surrounding cities our size. This increase would bring us closer to the same tax rate that you would pay when shopping in cities like Ozark, Republic, Branson, and Springfield.

What is the current sales tax rate in Nixa?

The sales tax rate you see charged on a receipt when shopping in a store inside Nixa city limits shows a total rate of 7.475%. This is made up of the State’s Sales Tax (4.225%) plus the Christian County Sales Tax (1.5%) plus the Christian County 911 Sales Tax (.25%), plus the Nixa City Sales Tax (1.5%). The City’s sales tax consists of a .5% Transportation Sales Tax which is dedicated only to our Street Department, and a 1% General Sales Tax. The General sales tax revenue goes into the “General Fund” from which the city pays for Police, Parks, and all administrative and support functions such as HR, Finance, Legal, and Communications, which serve all city departments including the Police.

Why not ask for a property tax instead?

If the city were to raise its property tax, only property owners inside city limits would be contributing to fund the Police Department. A sales tax means everyone who shops in Nixa is contributing to fund the Police Department, regardless of where they live.

Will all this money really go towards Police rather than Parks or other things?

Yes. Our current sales tax rate is 1.5%. That’s currently made up of 1% for general fund and .5% for the Streets. If this proposed ¾% increase is approved by voters, we would then have a total city sales tax rate of 2.25%. The new .75% would be earmarked and dedicated only for law enforcement, and we could still use as much of the revenue from the old 1% general sales tax on Policing as needed, and we would still have revenue from the .5% transportation sales tax going to Streets.